Budgeting is a fundamental yet essential strategy for managing finances, crucial for steering clear of debt, achieving short and long-term financial goals, preparing for emergencies, and fostering financial responsibility [1]. It’s noteworthy that a significant majority of the Indian workforce, approximately 65%, experiences financial stress, highlighting the urgent need for effective money management practices such as budgeting, investments, and creating a robust savings plan [2].

The reality that a third of Indians don’t have any form of savings, and over half don’t have at least ₹10,000 saved, reveals a critical gap in achieving secure financial futures and emphasizes the importance of learning how to save money from salary, the essence of retirement planning, and the development of an investment portfolio that includes mutual funds, insurance policies, and adherence to the 50-30-20 rule for budgeting [2] [3]. This step-by-step guide aims to simplify the seemingly complex process of financial planning, from budgeting effectively to exploring various investment options and savings plans, to help you establish a sound emergency fund and achieve your financial goals.

Understand Your Income and Expenses

To effectively manage your finances and start saving from your salary, understanding your income and expenses is crucial. Here’s a detailed breakdown to help you get started:

1. Calculate Your Monthly Income Accordingly So You Save Money from Salary

- Estimate your total income: List all sources of income including salary, bonuses, incentives, interest earned, rental income, and any other sources of income.

- Adjust for payment frequency:

- If paid bi-monthly: Multiply your take-home pay for one paycheck by 24.

- If paid weekly: Multiply your weekly pay by 52, then divide by 12.

- For fluctuating pay: Sum up three months of income and divide by three for an estimated monthly income.

2. List and Categorize Your Expenses

- Fixed Expenses: These are recurring monthly payments such as rent, utility bills, loan EMIs, insurance premiums, and transportation costs.

- Variable Expenses: These include costs that can vary each month like groceries, dining out, entertainment, and travel.

- Annual and Irregular Expenses: Include expenses that occur yearly or semi-annually by dividing the total annual cost by 12 and setting aside this amount each month.

3. Apply the 50/30/20 Rule for Budget Allocation For Save Money from Salary

- Essential Needs (50% of income): Cover necessities such as housing, food, utilities, transportation, and minimum loan payments.

- Wants (30% of income): Allocate for non-essential expenses like dining out, entertainment, subscriptions, and leisure travel.

- Savings and Debt Repayment (20% of income): Use this portion for building an emergency fund, saving for future goals, and reducing debts starting with high-interest ones.

By following these steps, you can create a clear and actionable financial plan that helps you track and manage your income and expenses effectively.

Create a Budget That Works for You Also Lead To Save Money from Salary

To create a budget that effectively supports your financial goals, follow these structured steps:

- Set Clear Financial Goals:

- Determine what you aim to achieve with your budget, such as debt repayment, saving for a vacation, or building an emergency fund.

- Use online savings calculators to set realistic financial goals and ensure your needs align with your plan.

- Track and Categorize Your Expenses:

- Organize your purchases using an expenses worksheet to distinguish between fixed, variable, and discretionary expenses.

- Regularly track your spending by reviewing the past three months of bank statements or using online tools like money management apps.

- Identify expenses that can be reduced or eliminated to free up more funds for your goals.

- Budget Allocation and Adjustment:

- Apply rules like the 50-30-20 or the 40-10-10-10-10-10 rule to allocate your income towards needs, wants, and savings.

- Regularly review and adjust your budget to ensure it aligns with your changing circumstances and financial goals. This may include adjustments due to changes in income, expenses, or priorities.

- Consider automating savings and investing to ensure consistent contributions towards your financial objectives.

By systematically following these steps, you can create a budget that not only helps manage your money more effectively but also progresses you towards a financially secure future.

Automate Your Savings

To ensure that saving becomes an effortless part of your financial routine, automating your savings is a crucial step. Here’s how you can automate your savings efficiently:

- Employer Retirement Plans and Automatic Transfers:

- Enroll in your employer’s EPF or other retirement plans and take advantage of any matching contributions.

- Set up an automatic transfer from your salary directly into your savings or investment accounts. This can be done through split deposit options or by setting up automatic transfers from your checking account to your savings account shortly after payday.

- High-Interest Savings Accounts:

- Choose a high-interest savings account for your automatic deposits. These accounts typically offer rates that are significantly higher than standard savings accounts, maximizing the return on your stored funds.

- Goal-Specific Savings Strategies:

- Create multiple savings accounts or subaccounts for different financial goals. This not only helps in organizing your savings better but also in tracking your progress towards each specific goal. Set up regular automatic transfers into each of these accounts to consistently build your funds without having to remember to transfer money each time.

By automating your savings, you not only ensure regular contributions to your financial goals but also reduce the temptation to spend the money elsewhere.

Cut Unnecessary Expenses

To effectively cut unnecessary expenses and enhance your savings from your salary, consider implementing these practical strategies:

- Streamline Bill Payments and Credit Usage:

- Consolidate bill due dates to simplify tracking and avoid late fees.

- Avoid charging crucial bills to credit cards to prevent interest charges and debt accumulation.

- Designate a single credit card for subscriptions to monitor and manage recurring charges more efficiently.

- Reduce Everyday Expenses:

- Dining and Entertainment: Pay with cash to control spending and cut back on frequent dining out.

- Monthly Bills: Opt for less expensive mobile and internet plans, reduce streaming subscriptions, and consider carpooling to lower transportation costs.

- Utility Savings: Implement energy-saving measures like using LED bulbs, setting programmable thermostats, and turning off appliances when not in use to significantly reduce electricity and water bills.

- Smart Shopping and Debt Management:

- Groceries and Household Items: Buy generic brands, use coupons, and stick to a shopping list to prevent impulse buys.

- High-Interest Debts: Prioritize their repayment to save on interest costs.

- Consider Lifestyle Changes: Such as renting in a less expensive area or getting a roommate to decrease housing costs.

By adopting these measures, you can effectively reduce your outgoings and allocate more towards your savings and financial goals.

Invest in Your Future

To effectively invest in your future and secure a financially stable retirement, consider the following strategies:

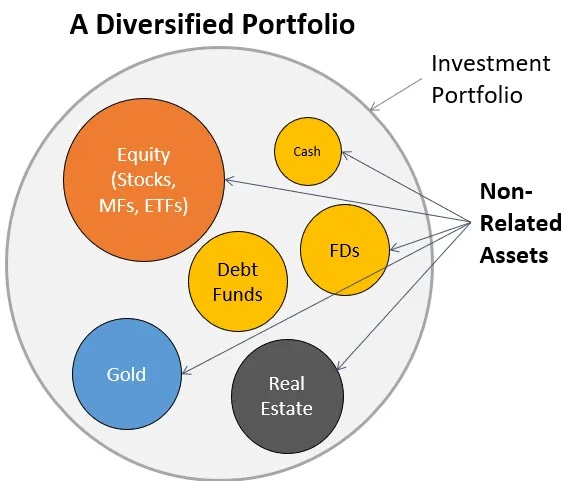

- Diversification of Investment Portfolio

- Equity Instruments: For those in their 20s, investing in stocks or equity-based mutual funds can offer higher returns due to the longer time horizon to mitigate risks.

- Debt Instruments: Senior citizens may prefer bonds or fixed deposits for stable and lower-risk income.

- Mix of Investments: Include a variety of assets like bonds, mutual funds, ETFs, and commodities like gold to balance risks and returns.

- Retirement Savings Plans

- Employer-Sponsored Plans: Maximize contributions to your EPF or other retirement plans, especially if your employer matches contributions, to leverage free money.

- Individual Retirement Accounts (IRAs): Consider opening a Roth IRA or contributing to traditional IRAs to benefit from tax advantages and flexible withdrawal options.

- Advanced Investment Options

- Real Estate: Invest in REITs or real estate crowdfunding platforms for potential income through rent and property appreciation.

- Index Funds: S&P 500 or Nasdaq-100 index funds offer diversification across top U.S. companies, suitable for long-term growth.

- Dividend and Value Stocks: Funds focusing on dividend-paying or undervalued stocks can provide regular income and capital appreciation, aligning with long-term financial goals.

By strategically managing and diversifying your investments, you can enhance your financial security and work towards achieving your long-term financial goals.

Monitor and Adjust Your Plan Regularly & Save Money from Salary

To ensure that your financial plan remains effective and adaptable to your evolving financial circumstances, consider incorporating these regular monitoring and adjustment practices:

- Automated Payments and Alerts:

- Set up autopay for consistent expenses such as rent, utility bills, and insurance premiums to prevent missed payments and potential penalties. Utilize alerts and reminders for your credit card and loan payments to stay on top of due dates and maintain a good credit score.

- Regular Review of Finances:

- Monthly Check-ins: Periodically review your automated finances and budget allocations to make necessary adjustments. This helps in accommodating changes in income or expenses and ensures that you are on track with your financial goals.

- Adjusting Savings and Investments: As you reach different milestones in your financial journey, celebrate these achievements to stay motivated. If you find surplus funds, consider increasing your savings rate or investing in higher yield opportunities.

- Debt Management:

- Prioritization of Payments: Focus on paying off high-interest debts first to reduce the total interest paid over time.

- Communication with Creditors: If you face challenges in making timely payments, communicate proactively with your loan service provider to explore possible adjustments to payment terms.

By maintaining discipline and regularly evaluating your financial strategy, you can effectively adapt to changes and continue progressing towards your long-term financial goals.

Conclusion

Throughout this guide, we’ve navigated the intricacies of saving money from your salary, underscoring the pivotal role of budgeting, cutting unnecessary expenses, automating savings, and wisely investing for a financially secure future. The principles laid out—from understanding your income and expenses, applying well-considered budgeting rules, to diversifying your investment portfolio—serve as a foundation for not just surviving, but thriving in today’s economic climate. These strategies not only aim to cushion against unforeseen financial shocks but also ensure steady progress towards achieving personal financial goals, whether they pertain to immediate needs or long-term aspirations like retirement.

By adopting a systematic approach to financial planning, incorporating regular reviews, and adjusting strategies as necessary, individuals can effectively navigate their financial journey with confidence and clarity. The importance of disciplined savings, prudent spending, and smart investing cannot be overstated in the quest for financial stability and independence. This guide, while a comprehensive starting point, serves as an impetus for further personal exploration and adaptation of financial strategies to meet the unique needs and circumstances of each individual, ultimately leading to a more secure and prosperous future.

FAQs

How can I effectively save money from salary?

To effectively save money from your monthly salary, it’s essential to:

- Create and adhere to a monthly budget plan to monitor your finances and manage your spending.

- Eliminate any existing debts.

- Engage in savings and investments.

- Ensure timely payment of your EMIs to avoid penalty costs.

- Automate your savings to ensure a consistent saving habit.

What does the 40 30 20 10 budget rule entail?

The 40 30 20 10 rule is a budgeting framework where:

- 40% of your post-tax income is allocated to essential needs like food and housing.

- 30% is directed towards discretionary spending.

- 20% goes towards savings or debt repayment.

- 10% is used for charitable contributions or achieving financial goals.

What is the principle behind the 50 30 20 budget rule?

The 50 30 20 rule is designed to help manage your finances by dividing your income into three categories:

- 50% for necessities, covering all essential expenditures.

- 30% for wants, which includes non-essential purchases.

- 20% for savings, also considering funds for future goals.

What are the most effective strategies for saving money for the future? To start saving money for the future effectively, consider the following strategies:

- Set clear financial goals early to motivate adherence to your savings plan.

- Gain a thorough understanding of your cash flows.

- Open and maintain a savings account.

- Reevaluate the use of your debit cards.

- Keep a close watch on your spending habits.

- Regularly review and adjust your emergency fund as necessary.

References

[1] – https://www.incharge.org/financial-literacy/budgeting-saving/how-to-make-a-budget/

[2] – https://www.chime.com/blog/how-to-save-money-from-your-salary-paycheck/

[3] – https://www.colorado.edu/health/blog/budgeting-tips

[4] – https://dfr.oregon.gov/financial/manage/pages/budget.aspx

[5] – https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

[6] – https://www.nerdwallet.com/article/finance/how-to-budget

[7] – https://www.nerdwallet.com/article/finance/nerdwallet-budget-calculator

[8] – https://www.wintwealth.com/blog/8-tips-on-how-to-save-money-from-your-salary-every-month/

[9] – https://www.ramseysolutions.com/budgeting/how-much-of-my-paycheck-should-i-save

[10] – https://www.incharge.org/financial-literacy/budgeting-saving/how-to-cut-your-expenses/

[11] – https://www.incharge.org/financial-literacy/budgeting-saving/making-saving-automatic/

[12] – https://www.chambers.bank/about-us/blog/what-it-means-and-how-to-automate-your-savings/

[13] – https://www.businessinsider.com/personal-finance/how-to-budget

[14] – https://www.fncb.com/Creating-a-Personal-Budget

[15] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/how-to-make-a-budget-and-stick-to-it

[16] – https://www.wellsfargo.com/financial-education/basic-finances/manage-money/budget/expenses/

[17] – https://www.ramseysolutions.com/saving/how-to-cut-costs

[18] – https://www.kiplinger.com/personal-finance/7-ways-to-automate-your-finances

[19] – https://www.bankrate.com/banking/how-to-automate-your-savings/

[20] – https://www.elementfcu.org/pay-yourself-first-how-to-automatically-start-saving-more-money/

[21] – https://www.theverge.com/23608794/personal-finance-automation-how-to

[22] – https://www.debt.org/advice/how-to-cut-expenses/

[23] – https://www.noblebank.com/4-ways-to-cut-unnecessary-expenses/

[24] – https://www.businessnewsdaily.com/5852-cut-business-expenses.html

[25] – https://money.usnews.com/money/personal-finance/saving-and-budgeting/slideshows/10-expenses-destroying-your-budget

[26] – https://www.linkedin.com/pulse/how-make-personal-budget-use-effectively-danielle-jerace-5ylwf?trk=public_post

[27] – https://www.forbes.com/advisor/investing/best-safe-investments/

[28] – https://www.nerdwallet.com/article/investing/the-best-investments-right-now

[29] – https://www.bankrate.com/investing/best-investments/

[30] – https://www.cnbc.com/select/best-short-term-investments/